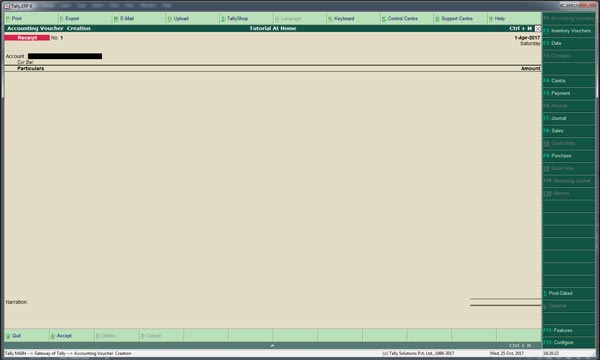

Voucher is the most powerful tools in accounts. It is the written proof of every transaction. Without the proper voucher, no transaction will be approved by the responsible authority. In Tally, the user should enter this vouchers carefully. Because tally calculates all other reports depending on this vouchers. In this document, accountant must be specifying the following points –

Generally, vouchers are two types –

But in tally, this vouchers are boldly divided by following types –

Contra voucher is used for cash transaction form

And so on ….

Generally, any transaction between the current assets A/c likes cash, bank, petty cash etc. (except sundry debtors). By these transactions are not changes the total current asset of the company.

Business can pay any money through cash or cheque through this type of vouchers. Payment like pay to

Business can receive any money through cash or cheque through this type of vouchers. Receive like, receive from

Journal vouchers are generally used for adjustment any wrong entry. But it may use for some another purpose also, like purchase fixed asset on credit. In general cash or banks are not allowed in journal voucher, but in the tally, it may possible by changing some settings.

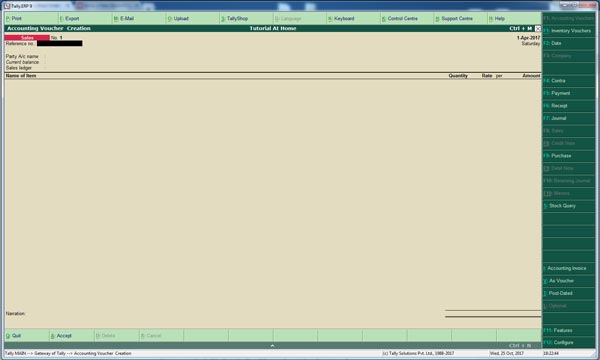

We can sale any trading products or services through this type of vouchers.

Sale

Sale

We can purchase any trading products or services (for sale, not for use) through this type of vouchers.

Some other special types of vouchares are also available in Tally, which will discuss below.